We fully admit to being a little obsessed with Christmas, so this was always going to happen. If any of these tips resonate and you need a chat, drop me a line! If you would like more information on any of these tips, please give the office a call on 01 639 2908 or email me on […]

SparksWealth Visual Insights: What you need to know about Market Corrections

What’s the number one mistake investors make when markets decline? Panic selling.1 It’s an emotional reaction to the sting of a correction. And it usually trades one problem for another—it replaces fear with seller’s remorse.2 You can avoid all of that if you know the facts about market corrections. This month’s Visual Insights Newsletter highlights […]

Reeling in the Years 2000 (inflation edition)

They say if you throw a frog into boiling water, it will jump out immediately. However if you gradually increase the heat, the frog won’t notice and happily swim away until it becomes frog stew. The same applies for inflation; we dont notice a 5 cent increase to our coffee in the morning, but over time this can […]

SparksWealth Visual Insights: How to Adopt Better Financial Behaviours

An experienced US financial planner once told me, that our principal job is to “not let clients do stupid things”. Humans aren’t robots. We frequently behave irrationally and make emotional decisions. These instincts and biases can have disasterous reprocussions for our finances. Build better finances by overcoming your brain’s natural tendencies with the behavioral finance […]

Inheritance tax is no crack! The best tip to pass on wealth the the next generation

Gifting our children or grandchildren is a very natural thing and something we’d like to do to help them along the way. Unfortunately this is not easy from a taxation point of view. We can only gift a certain amount in a life time before a 33% tax kicks in. The thresholds in Ireland are […]

SparksWealth Visual Insights: Election Year Investing

Do you know what one of the number one causes of market losses during an election year is? Fear.1 In fact, even for Irish investors the uncertainty of the US elections can stoke your fears. It may even encourage you to make rash, emotional decisions.1 That can lead to losses, but it doesn’t have to. […]

Who wants to be a *(half) Millionaire? Here is the habit that will get you there.

There is a popular myth in investing that the choice of investment fund is the most important and only aspect of long term savings that matters. This can be true and certainly is part of the process, but it is a minor factor. The most important thing in personal finance is NOT investment choice, […]

SparksWealth Visual Insights: The Bare Facts about Bare Markets

Do you know why bear markets happen? Or what you should do during them? If you were to read much of the media on the subject you’d never get out of bed! The point of this Visual Insights is to show that the hype and hysteria around Bear Markets is way worse than the reality. […]

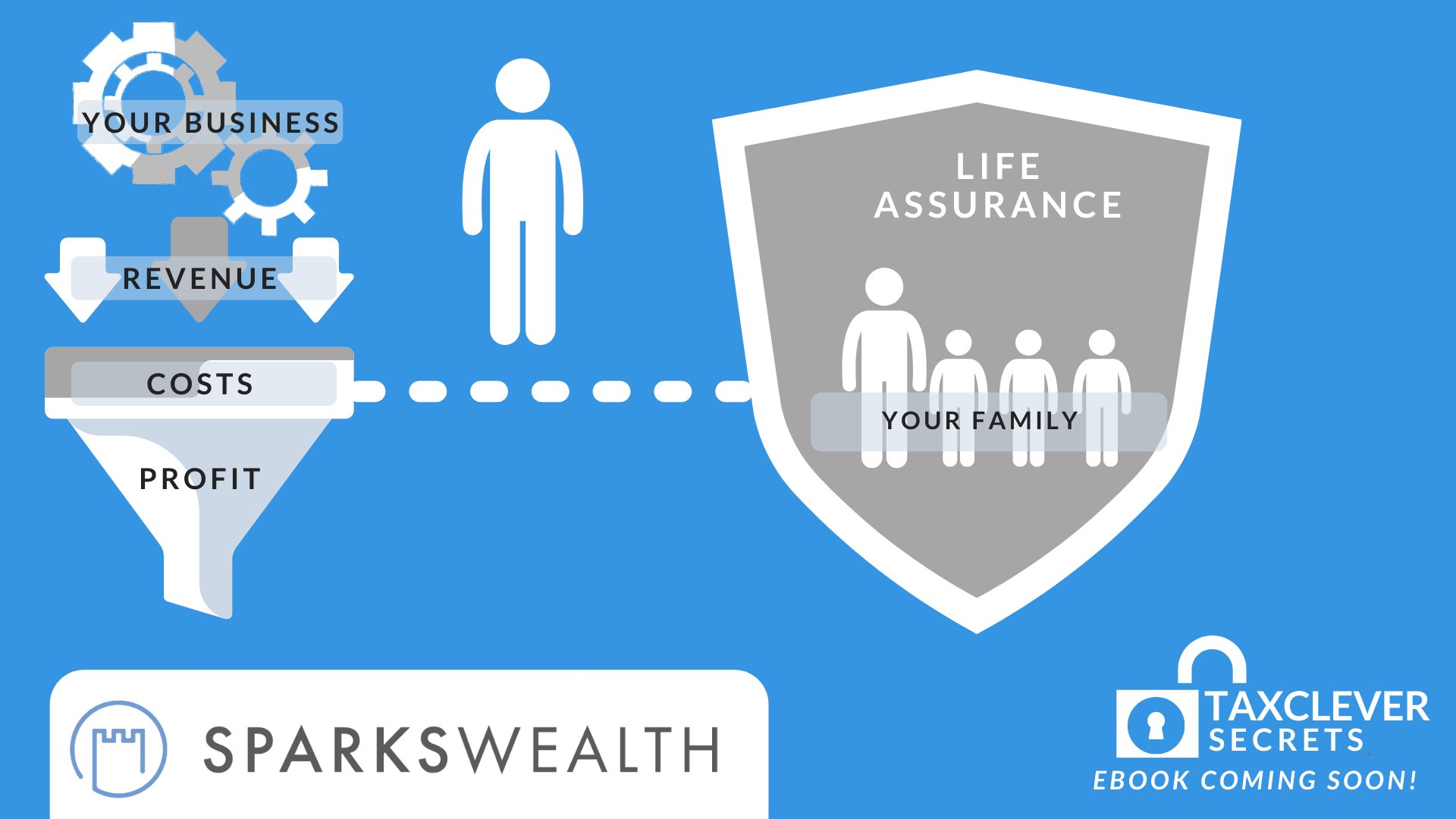

Business Owners- Save tax and pay your life assurance as a business expense!

Whilst we are building our businesses, most of us pay life assurance. We want to ensure our family can still thrive if we were to pass away unexpectedly. But did you know that you can pay life assurance through your company? As it stands you likely pay your life assurance out of your net salary. […]

SparksWealth Visual Insights: How to Be a Smarter Investor in Uncertain Times

Welcome to our first Visual Insights. Be sure to follow the link for the full Insight. We can’t control what markets or economies do. But we can control ourselves. No matter how much investing experience you have, uncertainty can get in the way of making good financial decisions. In fact, when market turbulence lets fear […]