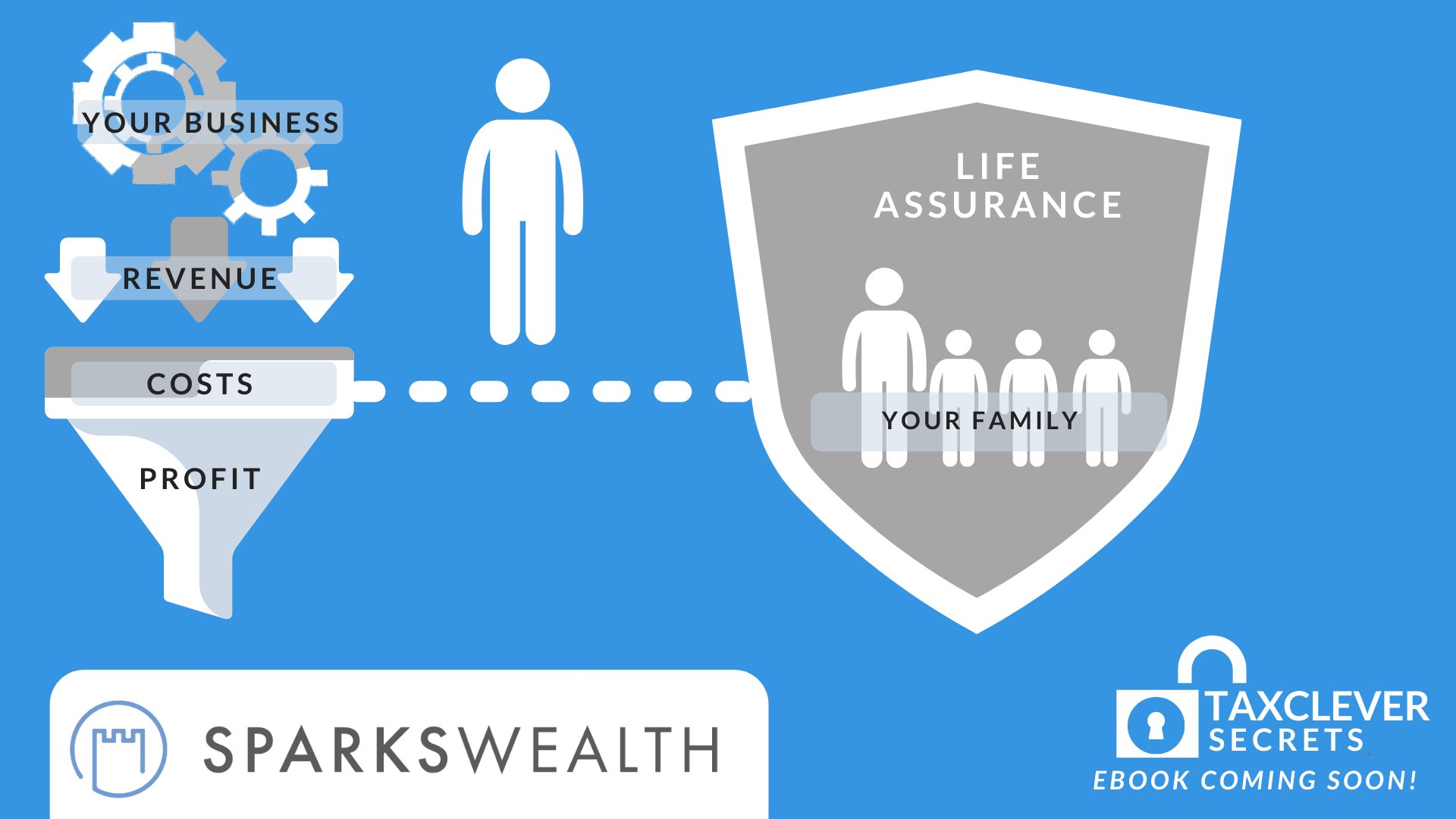

Whilst we are building our businesses, most of us pay life assurance. We want to ensure our family can still thrive if we were to pass away unexpectedly. But did you know that you can pay life assurance through your company?

Whilst we are building our businesses, most of us pay life assurance. We want to ensure our family can still thrive if we were to pass away unexpectedly. But did you know that you can pay life assurance through your company?

As it stands you likely pay your life assurance out of your net salary. It comes out of your current account as a direct debit every month and you rarely think about it. Well there is a better way.

This is one of the easiest “wins” out there for a business owner. Remember when you were employed by a company there was a “death in service” benefit in your contract? If you were to pass away whilst employed by the firm they would pay your surviving family a multiple of your salary (usually 4X).

You can recreate this benefit in your own company or business, protecting your loved ones if you were to pass away. The great thing is that unlike health insurance, there is no benefit in kind AND is deductible for Corporation Tax as a business expense.

As with all things in finance, they have to put some convoluted jargon as the product label. This type of life assurance is no exception in that regard, and is called Pension Term Assurance. Pension Term Assurance is one of the most under-utilised type of Life Assurance which is amazing given the clear tax saving.