Gifting our children or grandchildren is a very natural thing and something we’d like to do to help them along the way. Unfortunately this is not easy from a taxation point of view. We can only gift a certain amount in a life time before a 33% tax kicks in. The thresholds in Ireland are […]

Learning Centre

Tag: Wealth

Who wants to be a *(half) Millionaire? Here is the habit that will get you there.

There is a popular myth in investing that the choice of investment fund is the most important and only aspect of long term savings that matters. This can be true and certainly is part of the process, but it is a minor factor. The most important thing in personal finance is NOT investment choice, […]

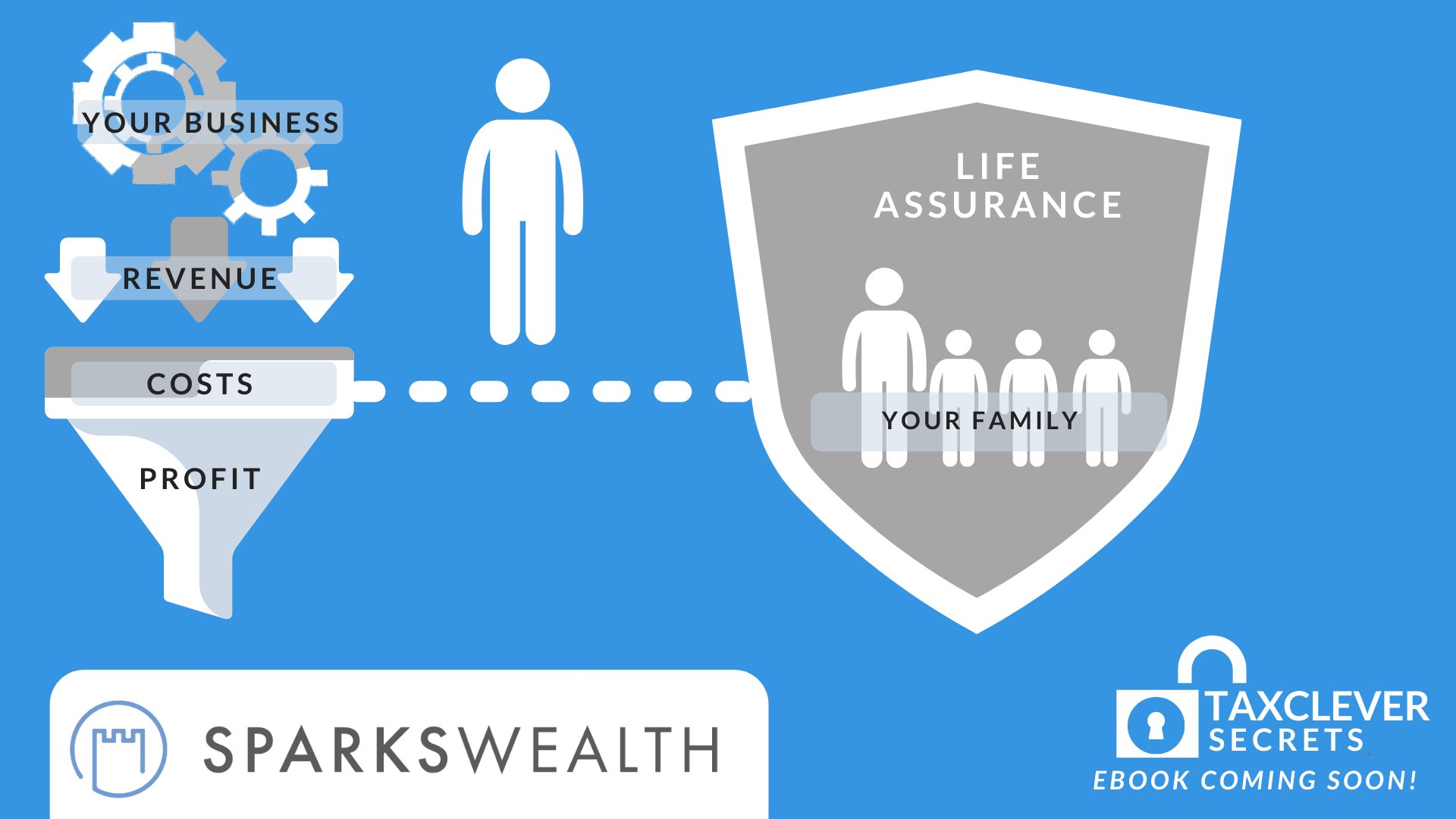

Business Owners- Save tax and pay your life assurance as a business expense!

Whilst we are building our businesses, most of us pay life assurance. We want to ensure our family can still thrive if we were to pass away unexpectedly. But did you know that you can pay life assurance through your company? As it stands you likely pay your life assurance out of your net salary. […]

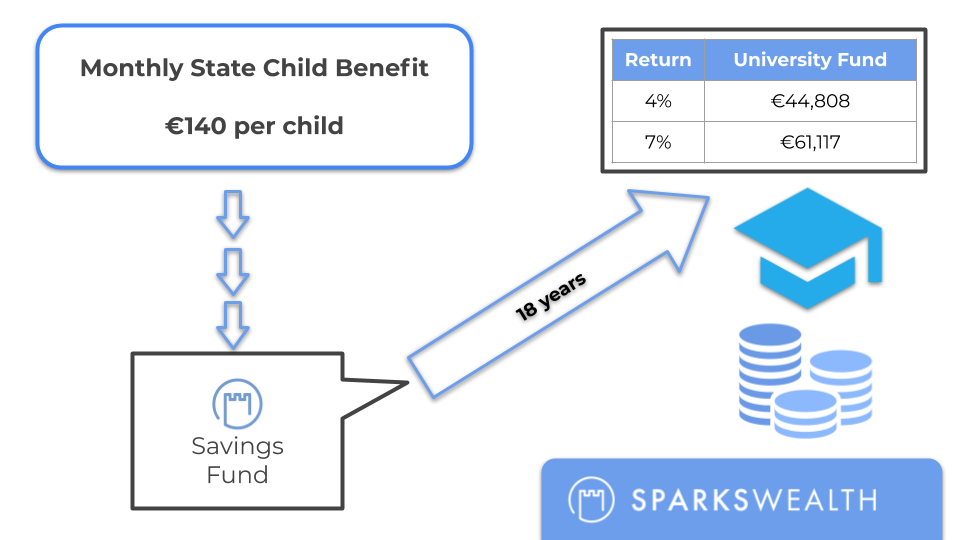

Attention Parents! Turn your child benefit into university fees with this easy tip

This is the easiest piece of advice that we are giving to anyone with children. It’s so simple, cheap and practical that there must be a catch. If you save the State Child Allowance every month, you will have saved enough to send your child to almost any college or university. On the first Tuesday […]