There is a popular myth in investing that the choice of investment fund is the most important and only aspect of long term savings that matters. This can be true and certainly is part of the process, but it is a minor factor. The most important thing in personal finance is NOT investment choice, timing, the state of the economy or otherwise; it’s habit.

So what habit turns us into (half) millionaires? saving discipline. Take a certain amount every month when you get paid and forget about it. The “forget about it” aspect is important- thats what makes it a habit. You don’t think about it, you set up a standing order or direct debit and its gone (from your current account).

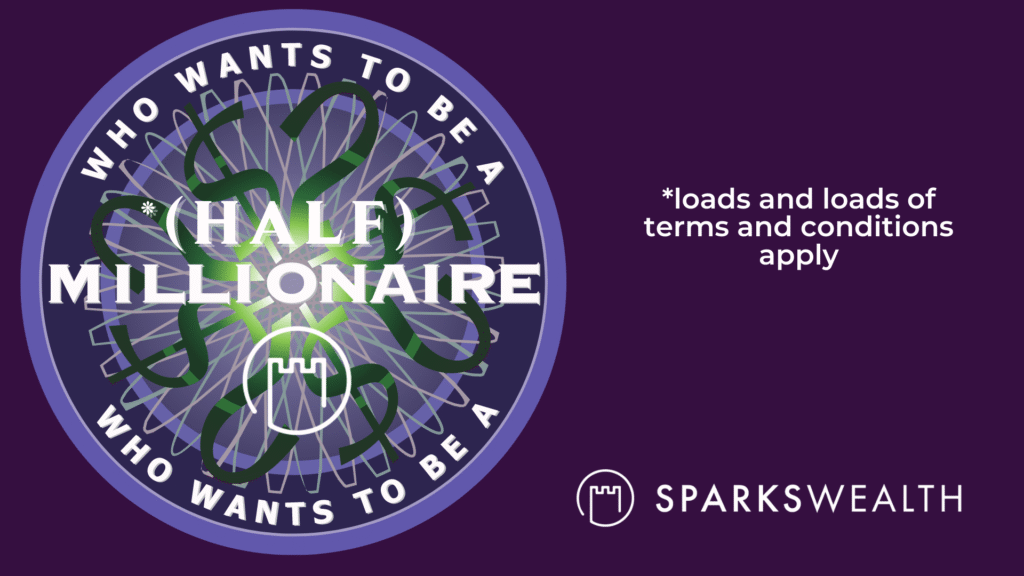

Let’s look at a few examples. Taking a 5% net return from an investment and a certain monthly savings contribution. Let’s see how long it takes to save €500k?

They are all right answers but using C above as a example, if you save €1500 every month and SparksWealth helps you with a return of 5%, in 17 years your fund will be over €500,000.

Final answer. (sorry couldn’t help myself!)

The saving figure is arbitrary, but the point remains; get in the habit of putting aside a certain amount every month and invest it in something that moves along with or above inflation.

Savings pots can take several forms depending on what your goal is (they shouldn’t be just lumped in together):

- Children’s Bare Trust (gift and inheritance vehicle)

- Children’s Education & Wedding Fund

- Later Life Fund

- Capital Gains Tax (CGT) Investment

- Pension Pots (just a different type of savings fund!)

We can help you organise and structure these savings in a tax efficient manner. It requires a little bit of work to get the structures set up, but it is easy after that.

If you would like more information on savings and pension plans, please give the office a call on 01 639 2908 or email me on will@sparkswealth.ie.

Business Owner? download our ebook: TaxClever Secrets: 7 Tax Strategies Every Irish Business Owner Needs to Know at taxclever.ie