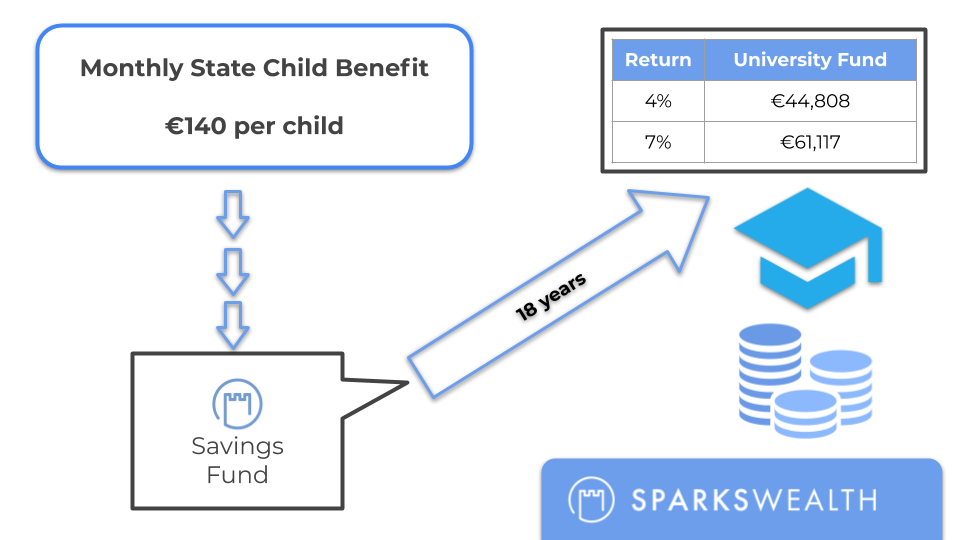

This is the easiest piece of advice that we are giving to anyone with children. It’s so simple, cheap and practical that there must be a catch. If you save the State Child Allowance every month, you will have saved enough to send your child to almost any college or university.

On the first Tuesday of every month, the Irish government gives every parent with a child under the age of eighteen; €140. For most of us, this €140 blends in with everything else and is spent before we even know it. However creating one small easy habit could change your child’s life and take away a future financial burden. So for any couple with young children, this savings action point is always in their SparksWealth financial plan.

Let’s take an example;

There is great joy in the Doyle household as Mary-Lou and Micheál have just had a baby boy; Leo. A short time later Mary-Lou and Micheál Doyle put together a financial plan with Will Sparks of SparksWealth. One of the action-points from the planning meeting is to put together a savings plan for €140 a month for Leos education. As the years roll by, the Doyles continue to save €140 a month right up until Leo’s 18th Birthday. Micheál and Mary-Lou check’s their savings account and they are pleasantly surprised that there is over €61k in the account. Lets look at how this happened:

| Year | 1 | 2 | 3… | …15 | 16 | 17 | 18 |

| Child Benefit Contributions (€140 * 12) | €1,680 | €1,680 | €1,680 | €1,680 | €1,680 | €1,680 | €1,680 |

| Opening Balance | €1,680 | €1,798 | €3,721 | €40,537 | €45,172 | €50,132 | €55,438 |

| Balance with Investment Growth (7%) | €1,798 | €3,721 | €5,779 | €45,172 | €50,132 | €55,438 | €61,117 |

The average return of their investment has been 7% per annum for Leo’s first 18 years. While the investment has been performing in the background, the €140 has been invested every single month without fail. You might argue that 7% per annum is too generous a return. Well let’s look at a poorer return of 4% per annum:

| Year | 1 | 2 | 3… | …15 | 16 | 17 | 18 |

| Child Benefit Contributions (€140 * 12) | €1,680 | €1,680 | €1,680 | €1,680 | €1,680 | €1,680 | €1,680 |

| Opening Balance | €1,680 | €1,747 | €3,564 | €31,960 | €34,985 | €38,132 | €41,404 |

| Balance with Investment Growth (4%) | €1,747 | €3,564 | €5,454 | €34,985 | €38,132 | €41,404 | €44,808 |

After 18 years, the Doyles would have €44,808 for Leo’s college fund. Admittedly it’s a lower sum but it still hits its objective; to have a pot of savings to pay for university. So what’s the moral of the story here? In personal finance we get so bogged down picking the right fund or investment that we don’t see what is important. The truth is that our granular financial habits like putting aside a little bit every month are the most important aspect of personal finance. Positive financial habits, however small, add up in the long term and create future opportunity. If you would like us to help you put in place a savings plan for you or your children, please give the office a call on 01 639 2908 or email me on will@sparkswealth.ie. The application is all online and couldn’t be easier!