Being parents of young children can be stressful and expensive. It also coincides with the period of time that most people start financially awakening and realise that it is time to give financial matters time and attention. This post focuses on a few small things you should be doing now as parents. If you […]

Learning Centre

Tag: Children’s Education

How Much Cash to Hold in 2021?

We frequently get asked by clients how much should they keep in cash? We still firmly believe that despite not getting returns in the bank, cash has a role in your personal finances. These few pointers will help you decide how cash to hold. If you would like more information on any of these tips, […]

The 12 Financial Tips of Christmas!

We fully admit to being a little obsessed with Christmas, so this was always going to happen. If any of these tips resonate and you need a chat, drop me a line! If you would like more information on any of these tips, please give the office a call on 01 639 2908 or email me on […]

Reeling in the Years 2000 (inflation edition)

They say if you throw a frog into boiling water, it will jump out immediately. However if you gradually increase the heat, the frog won’t notice and happily swim away until it becomes frog stew. The same applies for inflation; we dont notice a 5 cent increase to our coffee in the morning, but over time this can […]

Inheritance tax is no crack! The best tip to pass on wealth the the next generation

Gifting our children or grandchildren is a very natural thing and something we’d like to do to help them along the way. Unfortunately this is not easy from a taxation point of view. We can only gift a certain amount in a life time before a 33% tax kicks in. The thresholds in Ireland are […]

Who wants to be a *(half) Millionaire? Here is the habit that will get you there.

There is a popular myth in investing that the choice of investment fund is the most important and only aspect of long term savings that matters. This can be true and certainly is part of the process, but it is a minor factor. The most important thing in personal finance is NOT investment choice, […]

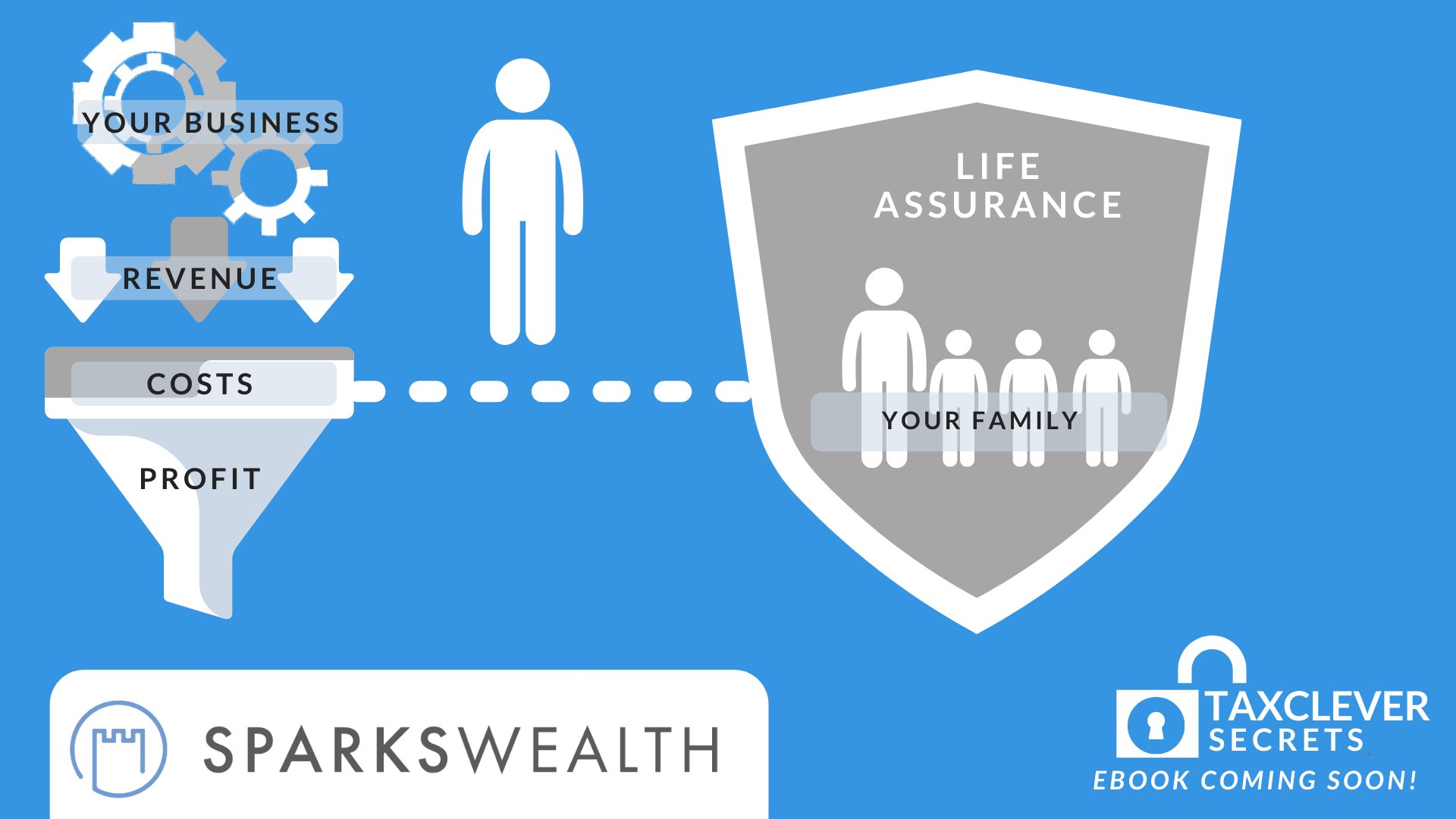

Business Owners- Save tax and pay your life assurance as a business expense!

Whilst we are building our businesses, most of us pay life assurance. We want to ensure our family can still thrive if we were to pass away unexpectedly. But did you know that you can pay life assurance through your company? As it stands you likely pay your life assurance out of your net salary. […]

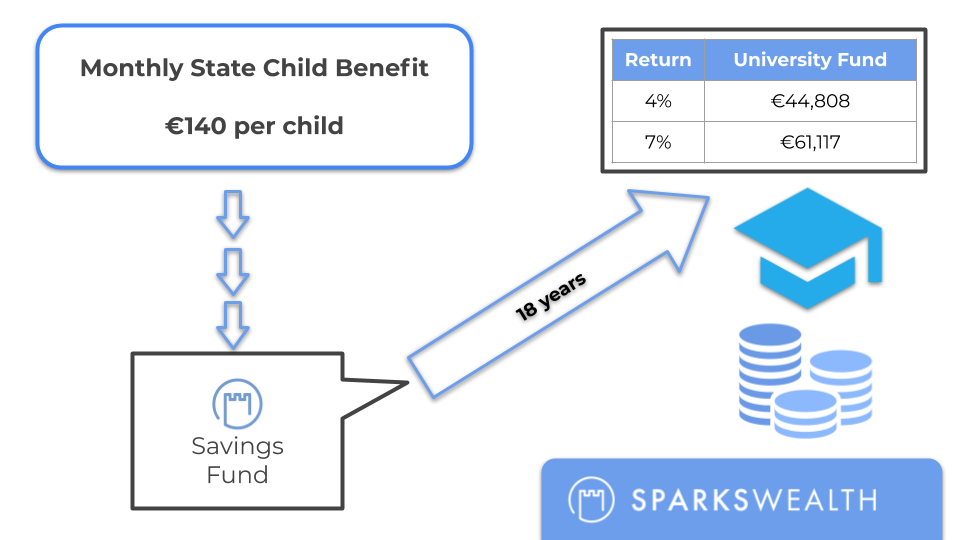

Attention Parents! Turn your child benefit into university fees with this easy tip

This is the easiest piece of advice that we are giving to anyone with children. It’s so simple, cheap and practical that there must be a catch. If you save the State Child Allowance every month, you will have saved enough to send your child to almost any college or university. On the first Tuesday […]