Inheritance tax is no crack! The best tip to pass on wealth the the next generation

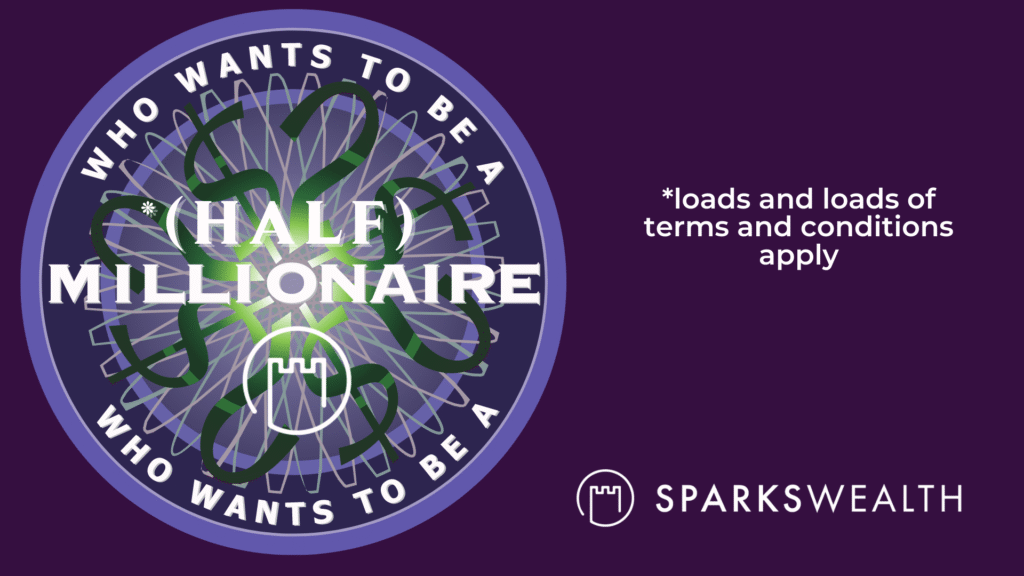

Gifting our children or grandchildren is a very natural thing and something we’d like to do to help them along the way. Unfortunately this is not easy from a taxation point of view. We can only gift a certain amount in a life time before a 33% tax kicks in. The thresholds in Ireland are […]

Inheritance tax is no crack! The best tip to pass on wealth the the next generation Read More »